Finance

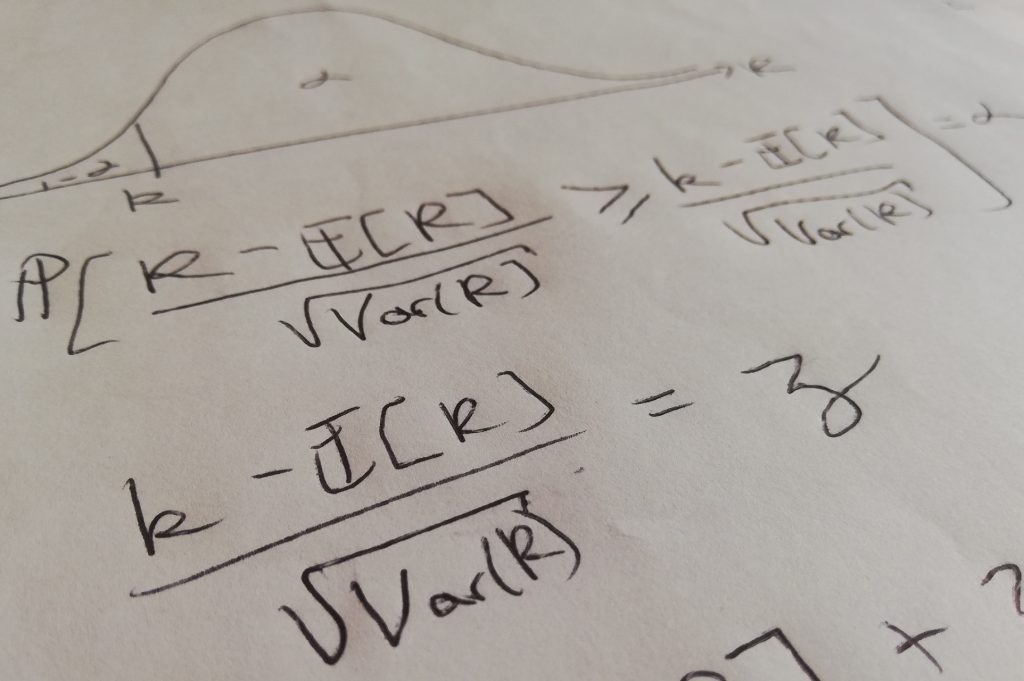

The Mathematics of VaR

A mathematical derivation of the Portfolio VaR highlighting the assumptions taken at each step

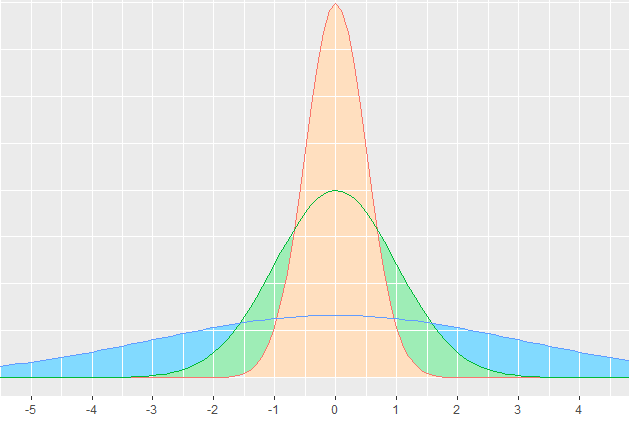

Common Questions about the Normal Distribution

Includes explanations of the z-scores, the confidence intervals and levels and the 68-95-99.7 rule

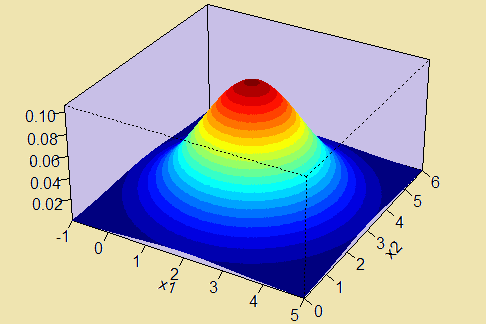

3D & Contour Plots of the Bivariate Normal Distribution

An analysis of the structure of the contours and the conditional distributions

Loan Prepayments

How does an increase in the loan repayments affect the banks' future interest income and assets?

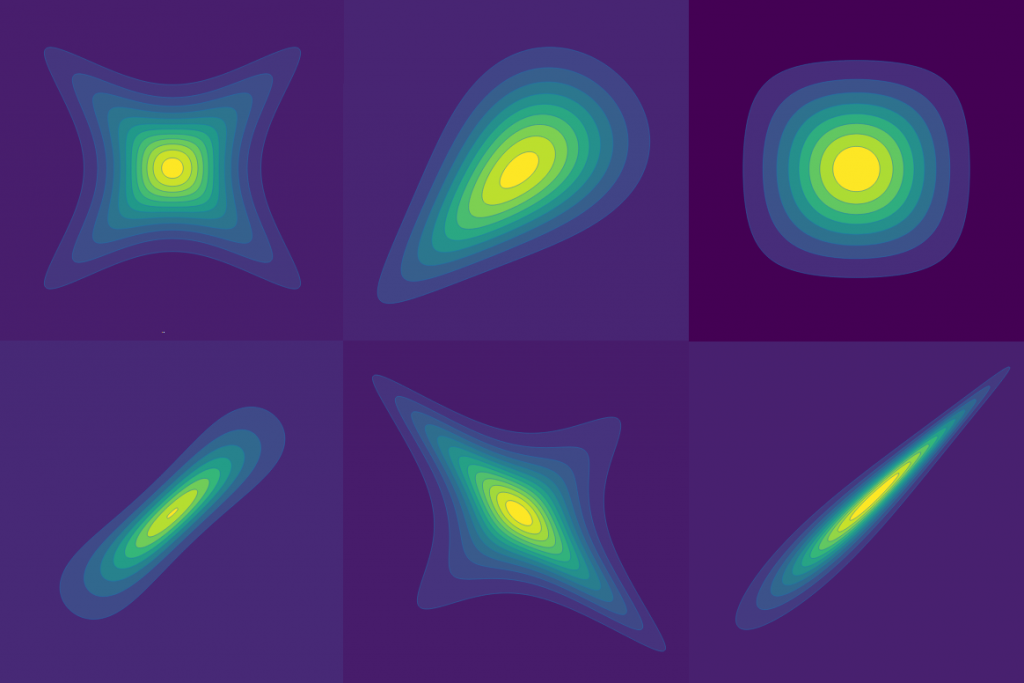

Different Correlation Structures in Copulas

Comparisons between the Gaussian, Student t, Frank, Gumbel and Clayton copulas

Portfolio VaR in 8 Steps

Step-by-step worked example of the Portfolio Value-At-Risk in Excel

Computing the Portfolio VaR using Copulas

Modelling the marginals and the correlation structure with a copula in order to find the VaR figure

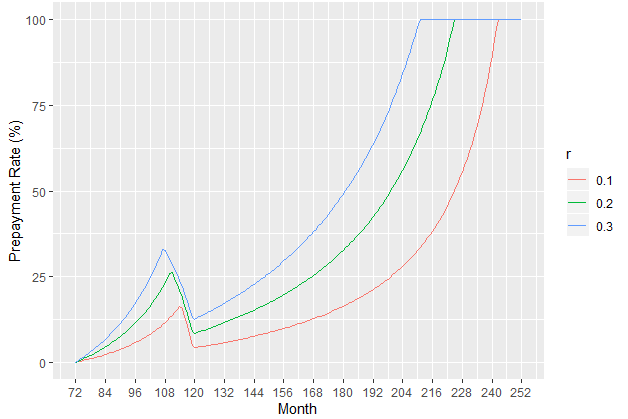

Loan Prepayment

Calculating the Prepayment Rate, Prepayment Rate Curves, Interest Lost resulting from an increase in repayments or a decrease in the interest rates

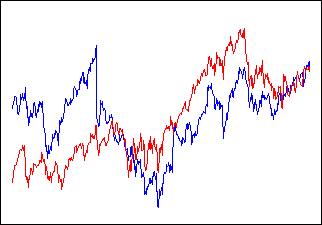

VaR Variance-Covariance Method Calculator

An application whose inputs are stock names and quantity, and computes the value, distribution and VaR