The Mathematics behind portfolio VAR

Introduction

In this article we define VaR and give a brief overview of how it is used to quantify the risk of a portfolio. We will then go into a step-by-step mathematical derivation of VaR, whilst highlighting and discussing the various assumptions used along the way. The awareness of such assumptions is important to ensure reliable results and the use appropriate of models in order to avoid underestimation of risk.

Definition of VaR

Suppose that we have a portfolio of assets. Each asset has an associated price which changes from one time unit to the next. Hence the total value of the portfolio changes from one time unit to the next. The time unit could be a day, 5-day period, 1 week, 1 month, and so on. The choice of the time unit depends on how the historic data of prices is presented and the time horizon of the VaR calculation (as we shall see).

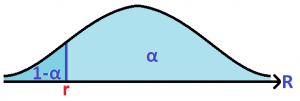

The term VaR stands for Value-At-Risk and has an associated time horizon and level of confidence. Let us say that the time horizon is 1 time unit for now. An ![]() 1-time unit VaR is the value

1-time unit VaR is the value ![]() by which with a level of confidence (or probability) of

by which with a level of confidence (or probability) of ![]() , the value of the loss suffered during 1 time unit would be not be greater than

, the value of the loss suffered during 1 time unit would be not be greater than ![]() . As an example, if the 95% 5-day VaR is €100,000, then with a level of confidence of 95% , it is expected that the loss suffered during a 5-day period will not be greater than €100,000.

. As an example, if the 95% 5-day VaR is €100,000, then with a level of confidence of 95% , it is expected that the loss suffered during a 5-day period will not be greater than €100,000.

Consider the 1-time unit portfolio rate of return ![]() defined by the percentage change in the value of the portfolio from one time point to the next. Suppose that we know the distribution of the

defined by the percentage change in the value of the portfolio from one time point to the next. Suppose that we know the distribution of the ![]() . Let

. Let ![]() be the the value of

be the the value of ![]() . This means that the 1-time unit rate of return of the portfolio will be greater than

. This means that the 1-time unit rate of return of the portfolio will be greater than ![]() ,

, ![]() of the time.

of the time.

Then the ![]() 1-time unit VaR is equal to

1-time unit VaR is equal to ![]() , where

, where ![]() is the total value of the portfolio.

is the total value of the portfolio.

Derivation of VaR

Suppose we have a portfolio of ![]() assets. Let

assets. Let ![]() . Let

. Let ![]() be the number of units of asset

be the number of units of asset ![]() . Let

. Let ![]() be the price of each unit of asset

be the price of each unit of asset ![]() . Let

. Let ![]() be the total value of asset

be the total value of asset ![]() . Hence

. Hence ![]() . Let

. Let ![]() be the rate of return from asset

be the rate of return from asset ![]() during one time unit and let

during one time unit and let ![]() be the return from asset

be the return from asset ![]() . Hence we have

. Hence we have ![]() .

.

The portfolio can be described by the set ![]() . Let the total current value of the portfolio be

. Let the total current value of the portfolio be ![]() , where

, where ![]() . The total return on the portfolio

. The total return on the portfolio ![]() during one time unit is the sum of the return from each asset present in the portfolio. Thus

during one time unit is the sum of the return from each asset present in the portfolio. Thus ![]() . Finally the rate of return

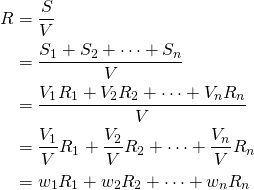

. Finally the rate of return ![]() on the whole portfolio is given by:

on the whole portfolio is given by:

where ![]() for

for ![]() and represents the weight of asset

and represents the weight of asset ![]() in the portfolio at the current time.

in the portfolio at the current time.

For every ![]() , let

, let ![]() be a random variable with mean

be a random variable with mean ![]() and variance

and variance ![]() (not to be confused with VaR which represents the Value-At-Risk).

(not to be confused with VaR which represents the Value-At-Risk).

Then the mean ![]() of the portfolio rate of return

of the portfolio rate of return ![]() is given by:

is given by:

![]()

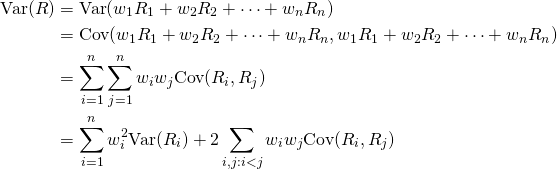

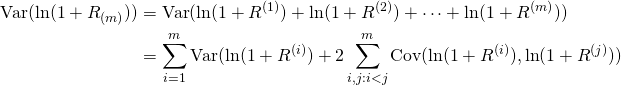

and the variance ![]() of the portfolio rate of return

of the portfolio rate of return ![]() is given by:

is given by:

where ![]() is the covariance between

is the covariance between ![]() and

and ![]() .

.

Hence ![]() is a random variable with mean

is a random variable with mean ![]() and variance

and variance ![]() , given in terms of the means, variance and covariances of

, given in terms of the means, variance and covariances of ![]() . In order to characterise

. In order to characterise ![]() completely, we need to know the values of

completely, we need to know the values of ![]() and

and ![]() , and also its distribution function.

, and also its distribution function.

Estimating the mean of the portfolio return  and its variance

and its variance

It is common practise that a series of prices is gathered for each asset over a time horizon common for all assets. Then the percentage change of a price of an asset, from one time unit to the next is the rate of return for that asset at that particular time interval. Hence a series of rates of return is obtain for each asset in the portfolio. The sample mean and the sample variance of each of these series are taken to be estimates of ![]() and

and ![]() .

.

Hence it is assumed that the means and the variances are independent of time. So time should not have any effect on the means and variances (no heteroscedasticity). In the case when the mean is increasing over the time horizon of the historic data, the risk is overestimated and vice-versa. In the case when the variance of the rates of return is increasing over the time horizon of the historic data, the risk is underestimated, and vice-versa. So one must check that the means and variances are more or less constant over the period of study.

Moreover the sample covariances between the ![]() series of rates of return are taken to be estimates of the covariances between the

series of rates of return are taken to be estimates of the covariances between the ![]() ‘s. Here it is assumed that the correlation structure is uniform over the values of the

‘s. Here it is assumed that the correlation structure is uniform over the values of the ![]() ‘s. Consider for example the case of positively correlated series (of rates of return). It is assumed that the correlation when the

‘s. Consider for example the case of positively correlated series (of rates of return). It is assumed that the correlation when the ![]() ‘s are positive is the same as that when the

‘s are positive is the same as that when the ![]() ‘s are negative. In the case when the correlation is higher when the

‘s are negative. In the case when the correlation is higher when the ![]() ‘s are negative, the risk is underestimated.

‘s are negative, the risk is underestimated.

Estimating the distribution of

It is common practise that each ![]() (for

(for ![]() ) is assumed to be normally distributed. In the case where the actual distribution is symmetric but has fatter tails than the normal distribution (positive excess kurtosis), the risk is underestimated, and vice-versa. This is known as kurtosis risk. In the case of an actual distribution which is skewed to the left (negatively skewed), there is underestimation of risk and vice-versa. This is known as skewness risk.

) is assumed to be normally distributed. In the case where the actual distribution is symmetric but has fatter tails than the normal distribution (positive excess kurtosis), the risk is underestimated, and vice-versa. This is known as kurtosis risk. In the case of an actual distribution which is skewed to the left (negatively skewed), there is underestimation of risk and vice-versa. This is known as skewness risk.

When we assume that each ![]() follows the normal distribution and moreover that the joint distribution of the

follows the normal distribution and moreover that the joint distribution of the ![]() ‘s is the multivariate normal distribution, then since

‘s is the multivariate normal distribution, then since ![]() is a linear combination of the

is a linear combination of the ![]() ‘s,

‘s, ![]() itself is normally distributed with mean

itself is normally distributed with mean ![]() and variance

and variance ![]() , estimated as described above.

, estimated as described above.

Estimating the 1-time unit  VaR

VaR

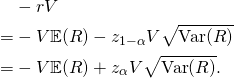

We would like to find ![]() such that

such that ![]() . We have:

. We have:

![Rendered by QuickLaTeX.com \begin{equation*}\begin{split}\mathbb{P}[R\geq r]&=\alpha\\\mathbb{P}[\frac{R-\mathbb{E}(R)}{\sqrt{\mbox{Var}(R)}}\geq \frac{r-\mathbb{E}(R)}{\sqrt{\mbox{Var}(R)}}]&=\alpha\end{split}\end{equation*}](https://datasciencegenie.com/wp-content/ql-cache/quicklatex.com-0c16f7c4a30d8a9e9bf35b5c2de2ad71_l3.png)

The random variable ![]() follows the standard normal distribution (since

follows the standard normal distribution (since ![]() is assumed to follow the normal distribution). Hence

is assumed to follow the normal distribution). Hence ![]() where

where ![]() is the

is the ![]() -score with probability

-score with probability ![]() . Therefore:

. Therefore:

![]()

The ![]() VaR is given by:

VaR is given by:

Sometimes when the value of ![]() is very small, it is assumed that

is very small, it is assumed that ![]() . This simplifies the VaR equation even further to just:

. This simplifies the VaR equation even further to just:

![]()

Extending to the  -time unit

-time unit  VaR

VaR

The 1-time unit ![]() VaR could be extended to

VaR could be extended to ![]() -time units

-time units ![]() VaR. Let

VaR. Let ![]() be the portfolio rate of return over

be the portfolio rate of return over ![]() time units. In this case, the distribution of the portfolio logarithmic rate of return

time units. In this case, the distribution of the portfolio logarithmic rate of return ![]() is calculated and used as a proxy of the distribution of

is calculated and used as a proxy of the distribution of ![]() .

.

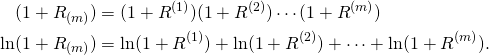

For ![]() , let

, let ![]() be the rate of return during the

be the rate of return during the ![]() time unit. Then:

time unit. Then:

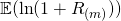

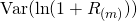

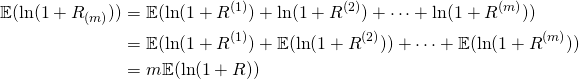

Let us find the expected value and the variance fo the random variable ![]() .

.

Approximating  and

and

since

Recall that the Maclaurin series of ![]() . When the value of

. When the value of ![]() is small, we have the approximation

is small, we have the approximation ![]() , which we shall refer to as the “Maclaurin approximation”. By using the Maclaurin approximation on the formula for the expected value, we obtain:

, which we shall refer to as the “Maclaurin approximation”. By using the Maclaurin approximation on the formula for the expected value, we obtain:

![]()

Consider now the variance.

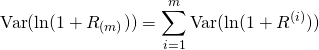

It is assumed that ![]() are not correlated, that is, there is no serial correlation present. Hence, in particular, situations in which a negative rate of return in one time point triggers a negative return in the time point, violates this assumption. By assuming that there is no serial correlation, the variance of the logarithmic rate of return reduces to:

are not correlated, that is, there is no serial correlation present. Hence, in particular, situations in which a negative rate of return in one time point triggers a negative return in the time point, violates this assumption. By assuming that there is no serial correlation, the variance of the logarithmic rate of return reduces to:

and moreover

![]()

since ![]() are identically distributed 1 time unit portfolio logarithmic rates of return. This is the well-known square root of time rule because here the standard deviation of the logarithmic rate of return over a period of

are identically distributed 1 time unit portfolio logarithmic rates of return. This is the well-known square root of time rule because here the standard deviation of the logarithmic rate of return over a period of ![]() units is equal to the standard deviation of the logarithmic rate of return over one time unit multiplied by

units is equal to the standard deviation of the logarithmic rate of return over one time unit multiplied by ![]() (where

(where ![]() is the time).

is the time).

By the Maclaurin approximation, the formula for the variance reduces to

![]()

Approximate distribution of

If ![]() and each

and each ![]() is approximated by the Maclaurin approximation in the equation

is approximated by the Maclaurin approximation in the equation ![]() , and carry on with the assumption that the portfolio rate of return is normally distributed, then we assume that

, and carry on with the assumption that the portfolio rate of return is normally distributed, then we assume that ![]() is normally distributed with mean

is normally distributed with mean ![]() and variance

and variance ![]() .

.

Hence the ![]() -time units

-time units ![]() VaR is

VaR is ![]() . Again, if

. Again, if ![]() is small and assumed to be zero, the VaR would reduce to

is small and assumed to be zero, the VaR would reduce to ![]() .

.

Conclusion

We have gone through the mathematical derivation on the VaR equation for 1 time unit and for larger time horizons. The assumptions taken at each steps are highlighted. This is important for the risk manager to be aware of the assumptions being made and to make sure that the movement in the prices do not violate such assumptions. This will ensure that the portfolio risk is not underestimated and that the results are reliable.